Explore my Ops space

Ray & Pi

Miraculous : Ladybug et Chat Noir

Sonic The Hedgehog: 2

🚀 8 Years Professional Experience

Solutions Architecture

@ Next Pixel Entertainment

Hybrid cloud solutions leveraging IaC, containerization, golden image creation, observability, microservices, and server-less technologies.

VFX Pipeline Engineer

@ MPC VFX; ON Animation Studios & Outpost VFX

Houdini, Nuke & Katana workflows, rendering and cloud infrastructure, color management, optimizations, package management and leadership.

DevOps Engineer

@ Next Pixel Entertainment

Infrastructure automation leveraging Packer, Ansible, and Terraform, micro-service orchestration with Kubernetes, and CI/CD pipeline provisioning.

✍️ Articles

Provisioning Grafana on DigitalOcean Kubernetes Service

I deployed Grafana with multiple data sources to DOKS using Helm & Terraform.

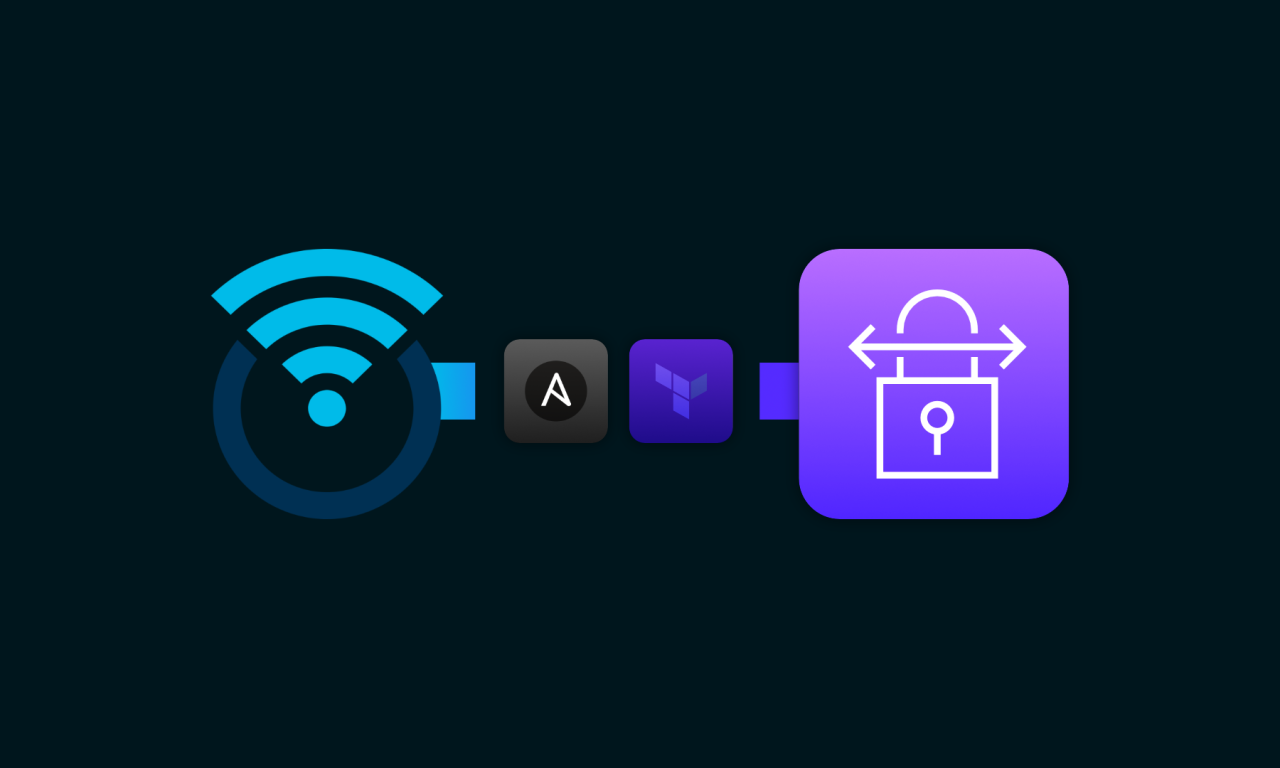

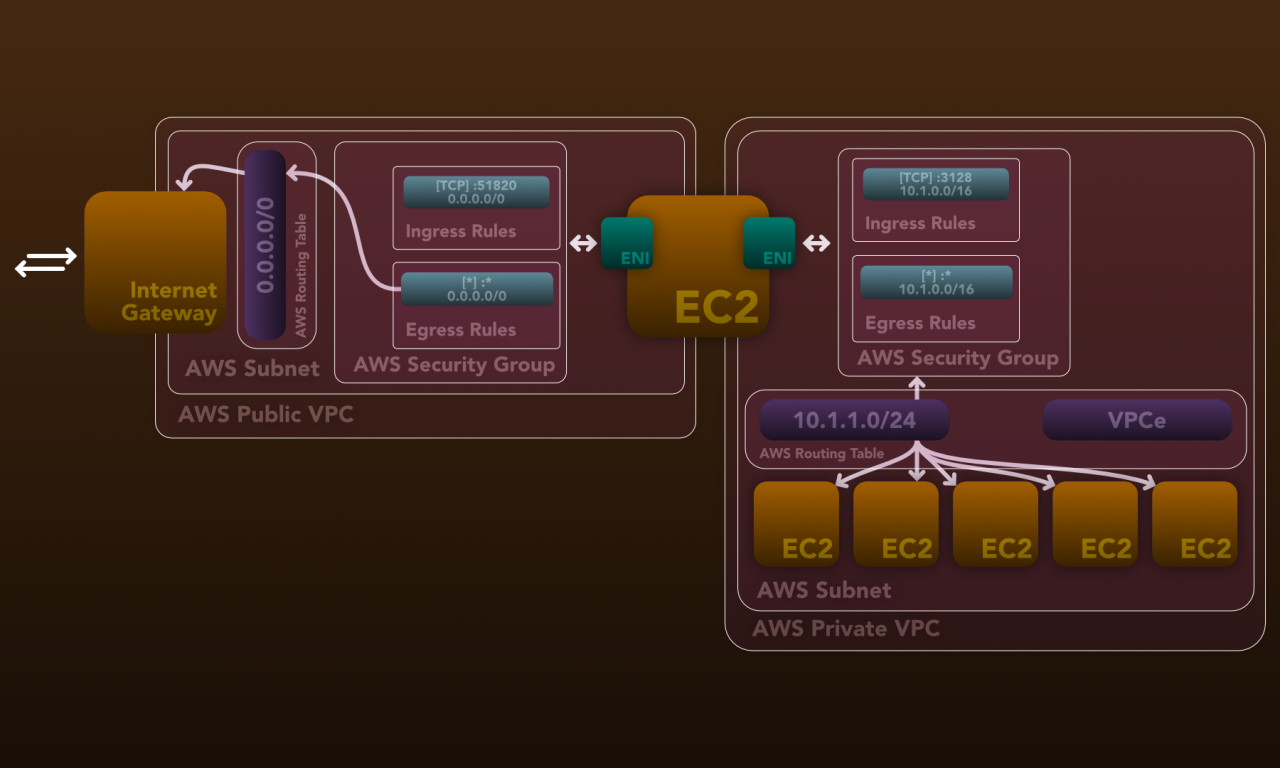

Deploying AWS Site-to-Site on OpenWRT

I connected OpenWRT to AWS using IPSec, BGP, Ansible and Terraform.

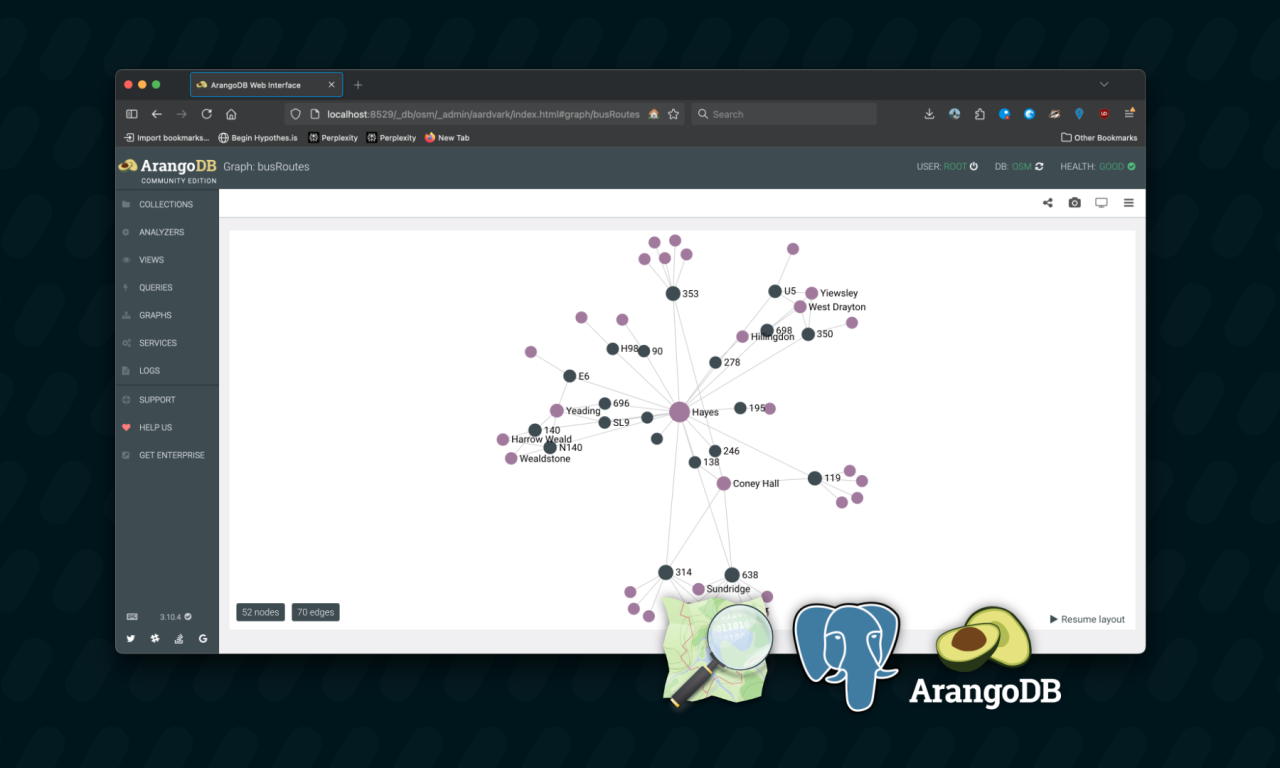

Bus route-finding with PostGIS and ArangoDB

I created a bus route finding tool using PostGIS and ArangoDB

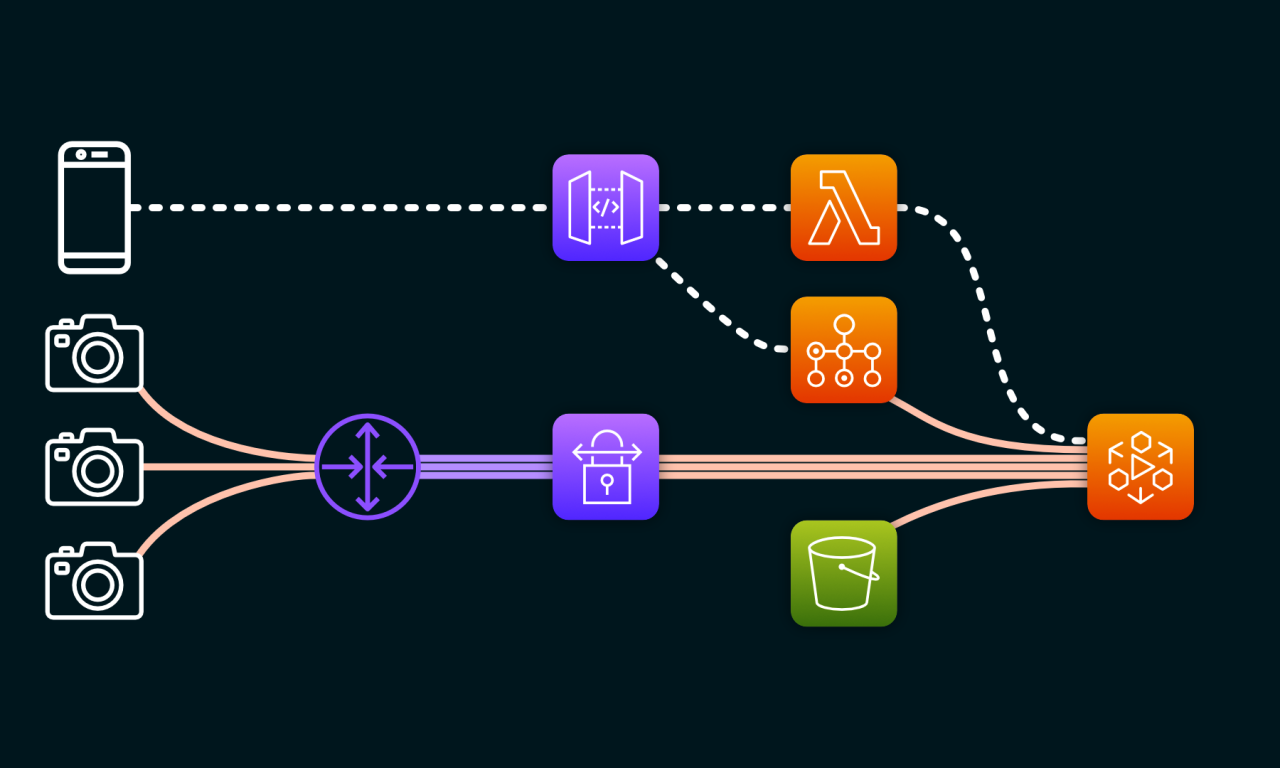

Streaming a bike riders’ journey with AWS MediaLive

I plan to create a live streaming setup for bike journeys using GoPro and AWS.

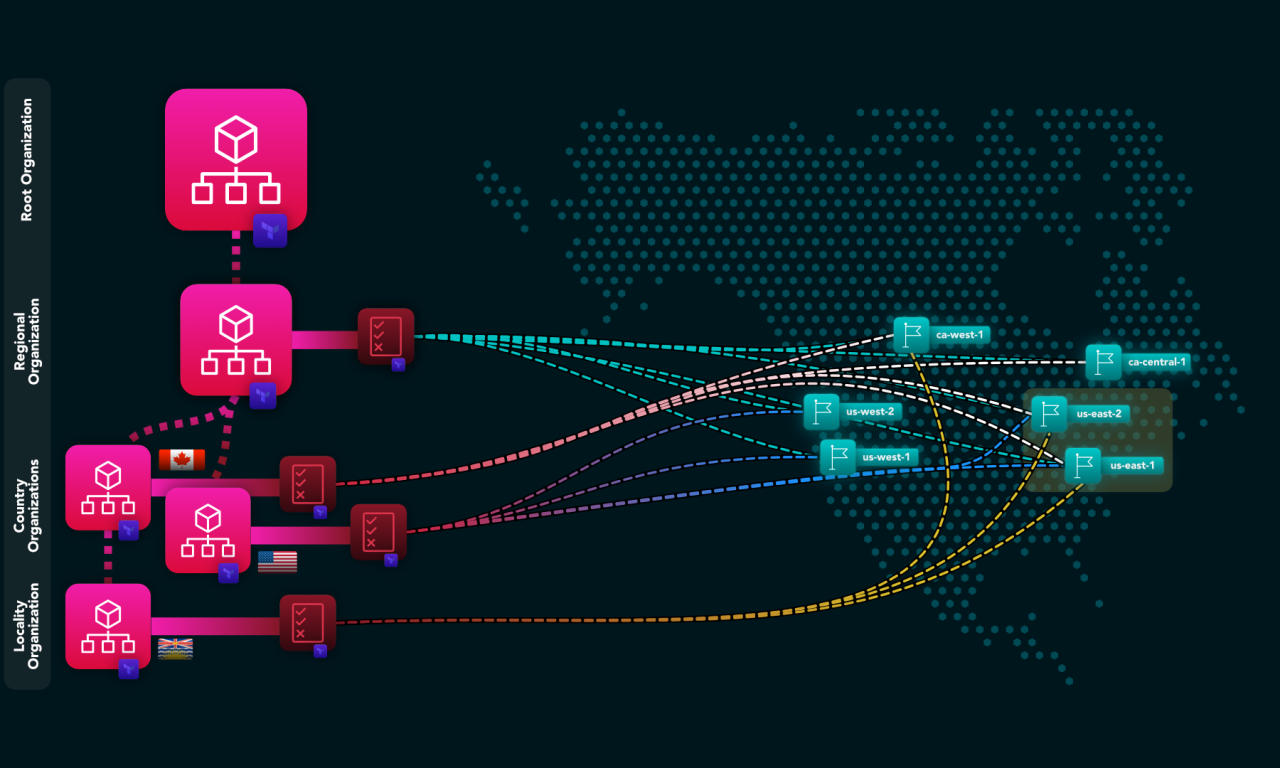

Deploying Region-locked AWS Organizations using Terraform

As a solutions architect, I was tasked with building an AWS Organizations hierarchy for a Canadian startup that needed to…

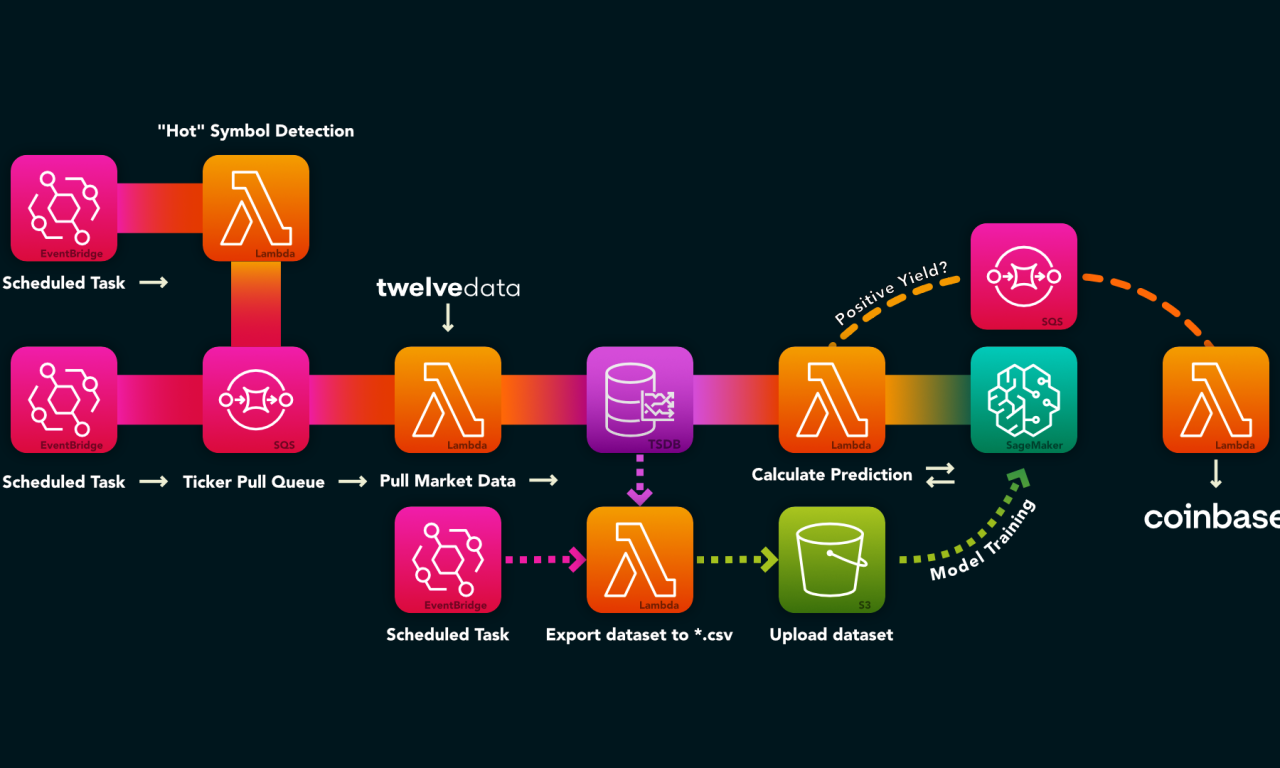

Idea: Adopting Serverless for Trading Operations

I’m not very into day-trading, but I see the potential in the market from time to time, so I came…

Outline: Extending a home network setup in AWS

As someone without a permanent base, I needed a secure and flexible cloud infrastructure that allowed me to spawn powerful…

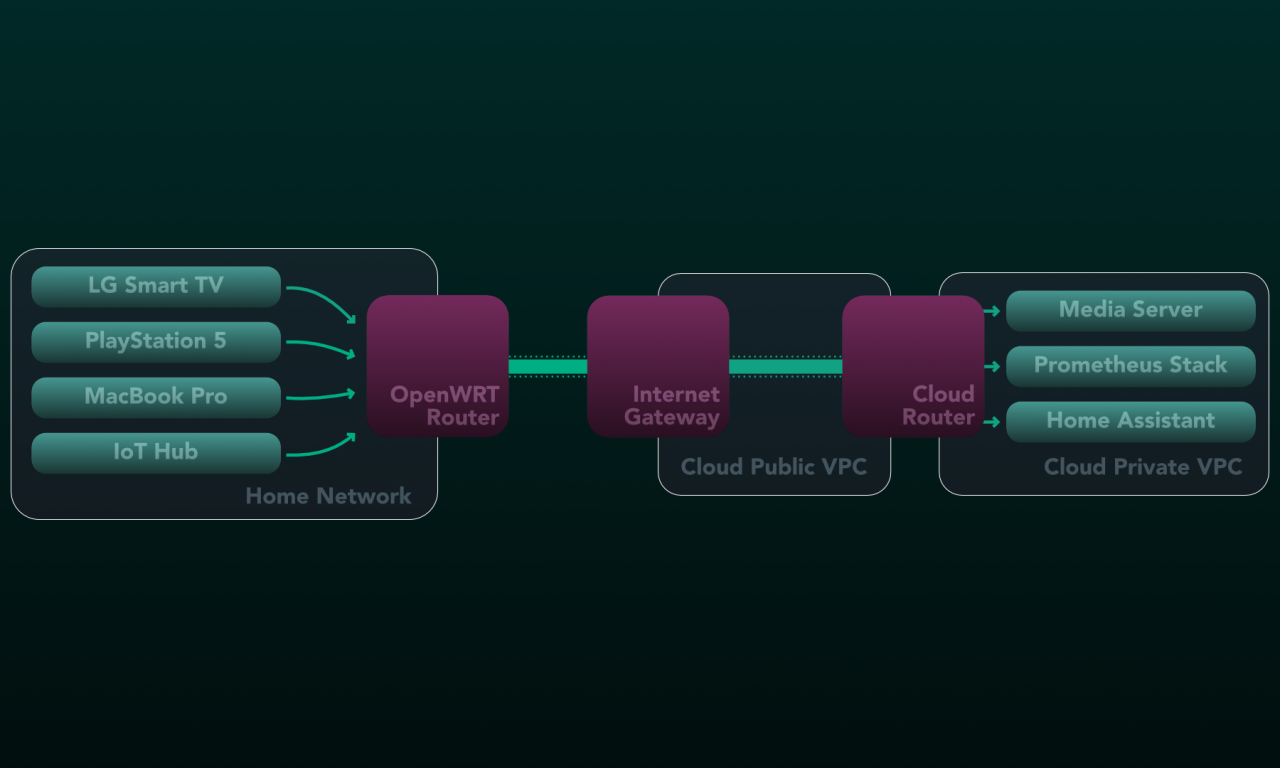

Overview: Extending my home network to the cloud

I deployed the services I run at home to the cloud due to constant relocation.

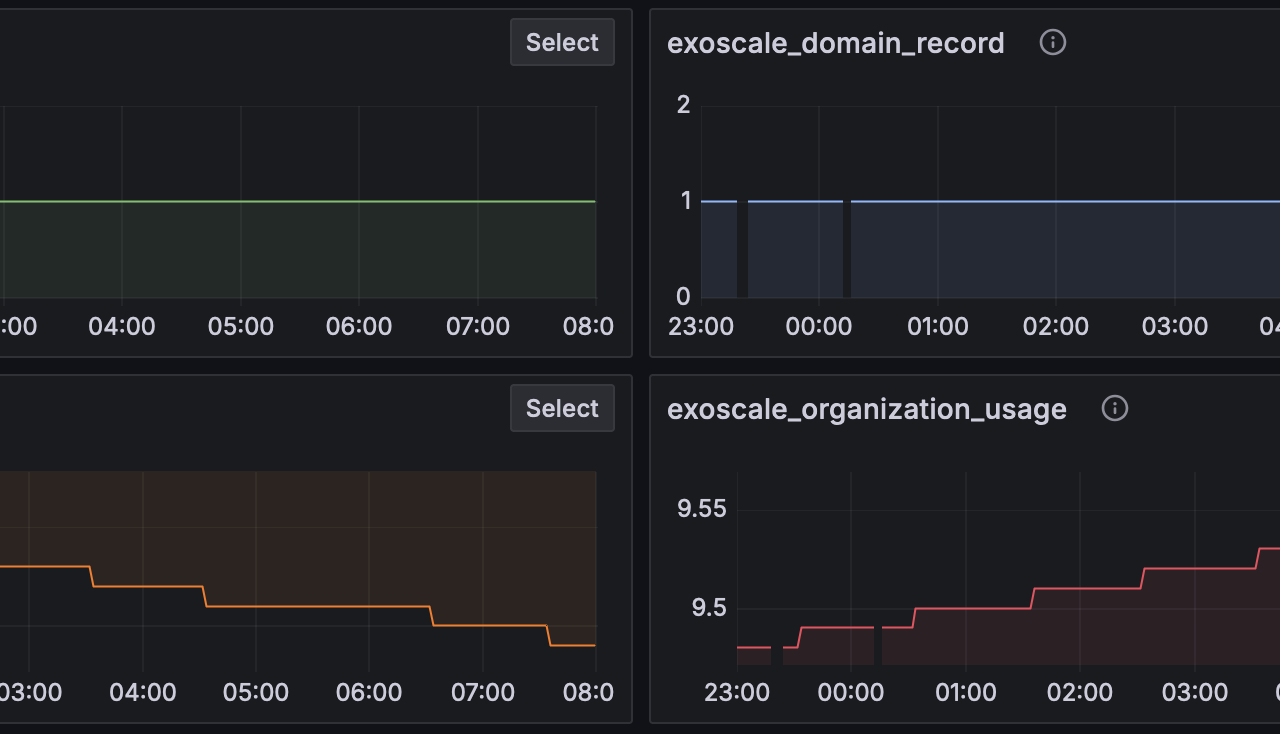

Exoscale Exporter for Prometheus

I’d built a Prometheus exporter for Exoscale, allowing me to visualize cloud spending and resource usage from a central location alongside AWS and DigitalOcean.